Key Challenges for CEOs in Poland in 2025

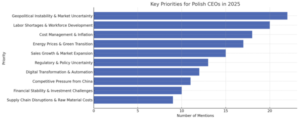

At the end of 2024, the International Executive Search Federation asked hundreds of CEOs from 18 IESF member countries about the challenges they expect in 2025. In this context, we randomly asked 29 business executives in Poland about the challenges they foresee for their businesses in 2025.

Our interviewees included CEOs from Polish, German, French, American, Belgian, Dutch, British, Chinese, Norwegian, and Slovak companies.

The average level of employment was 467 people, and the average revenue of the companies we spoke with was 440 million PLN, although two companies had revenues in the billions.

Our respondents mostly came from the manufacturing sector, but we also had representatives from leasing, B2B loans, insurance, wind energy, electromobility, gastronomy, and large-scale retail.

Those who made time for us were highly engaged and interested in our questions. We felt these conversations helped them organize their thoughts for the upcoming year.

Here are the results:

- Unpredictable Market Trends and Geopolitical Instability

Many companies recognize that market unpredictability is one of the main challenges, with geopolitical instability at the forefront. Factors such as: the ongoing war in Ukraine, shifting international relations, and political tensions are putting pressure on businesses across various industries. The growing uncertainty affects supply chains, production schedules, and overall business planning. This unpredictability leads to difficulties in forecasting what will be produced and ordered in specific markets, raising questions about the profitability of certain investments in Poland.

Shortage of Skilled Workers and Specialists

Companies across various industries struggle with a shortage of skilled frontline workers and specialists, particularly engineers. This issue is especially prevalent in technical roles, making sustaining and expanding operations difficult. It also impacts labor costs, not only in terms of recruiting frontline employees but also in training and retaining them. Intense competition for local and international talent is forcing many companies to rethink their hiring strategies and develop new workforce approaches. Manufacturing companies, project-based businesses, and the wind energy sector have reported the highest shortages in this area.

Few companies identified recruiting managers as a leading challenge for 2025.

There were also opinions highlighting the need to remodel business models. Some companies are expanding their operations and increasing employment through partnerships with cooperating firms, where entire business segments are managed by external companies that complement the service offering and employ their staff. This approach allows businesses to focus on core activities while distributing workforce responsibilities across multiple entities.

Inflation and Interest Rates

High interest rates and inflation are significant challenges for CEOs. The rising cost of credit limits investment opportunities, while inflation reduces profits, particularly in sectors with high operational costs, such as manufacturing and logistics.

Many companies adjust their pricing strategies and make different investment decisions in response to rising costs.

The high cost of credit also contributes to stagnation in the construction industry, as clients delay investment and spending decisions.

Green Deal and Environmental Profitability

The Green Deal presents a challenge, particularly for companies in the manufacturing sector. Businesses in Poland face the highest energy costs in Europe and high expenses for implementing eco-friendly solutions, which increase the cost of produced goods while trying to maintain profitability.

Adapting to environmental standards comes with significant costs that are not always easy to balance with financial performance. Rising labour costs also push companies to improve efficiency, introduce new workforce management strategies, and invest in more cost-effective technologies.

For some companies, this even means the necessity or risk of relocating production to countries with lower energy costs. In Europe, southern countries such as Portugal, Spain, Romania, and Turkey are being considered, while some businesses are also exploring destinations outside Europe.

Sales Growth and Expansion into New Markets

Due to changing demand in the local market, as well as a decline in orders from Western European countries (with Germany and France being mentioned most frequently), companies are facing the challenge of finding new markets for products manufactured in Poland.

Expanding into new markets comes with additional risks related to supply chain management, particularly in light of geopolitical tensions and logistical disruptions.

CEOs are focusing on developing new distribution channels but are encountering difficulties in balancing the need for growth with financial and logistical realities in these markets.

Interesting insights came from service-based companies, whose business clients increasingly expect a comprehensive “one-stop-shop” offering. Companies that successfully implement this approach can compete not only on price but also on the added value their product or service provides to the customer.

Legal Uncertainty and Ambiguities

Legal uncertainties, particularly regarding digital transformation and environmental regulations, pose a significant challenge. CEOs highlight the constantly changing regulations related to environmental standards and preferences for specific products (e.g., electric cars, heat pumps).

Companies must adapt to rapid technological advancements while simultaneously navigating complex legal frameworks, particularly in sectors such as wind energy.

Transformation Linked to Digitization and Automation

Digital transformation and automation require significant investment. Companies are factoring in the high costs of acquiring modern technologies, software licenses, employee training, and IT infrastructure maintenance.

The rise in digitization leads to an increasing volume of data stored in cloud systems and digital platforms, which heightens the risk of cyberattacks. As a result, companies are planning to invest in advanced security solutions to protect their data and infrastructure from attacks and data breaches.

Growing Competition from China

Strong competition from China and other low-cost production countries makes it difficult for companies in the manufacturing sector to maintain profit margins and plan for sustainable growth. This competition is becoming increasingly intense in industries such as electronics and high-tech products. In these sectors, cost pressure is significant, and Chinese products are steadily closing the quality gap with those from Germany and other Western European countries.

In the long run, there is a risk that production in Poland may need to be reduced due to growing demand for products from China.

The War in Ukraine and Its Impact on Investment Decisions in Poland

The ongoing war in Ukraine continues to impact multiple sectors, and companies, as well as business owners, are concerned about its long-term effects, such as an increased reluctance of parent companies to invest in Poland.

Supply Chain Problems and Component Costs

CEOs anticipate that companies will need to adapt to ongoing disruptions caused by geopolitical tensions and shifts in trade policies. Businesses are focused on diversifying their supply sources to mitigate the risks of delays and shortages.

An additional challenge is the quality of raw materials used in production, which often remains inconsistent, particularly in the food production sector.

Example Case Studies

1. Manufacturing – Heating Devices:

Challenges: Growing competition from cheaper imports, adapting to stricter environmental regulations, and responding to changing legal regulations in green energy, as well as forecasting the right product mix for the future.

Opportunities: Increased demand for heating solutions in the renewable energy sector in new markets. The ability to shift production to align with market demands

2. Wind Energy Industry – Services:

Challenges: Regulatory uncertainty affecting investment decisions, a severe shortage of highly skilled labor, and the complexity of financing projects.

Opportunities: The development of the renewable energy market driven by EU climate goals creates space for the growth of wind technology and the construction of new wind farms. There is a chance for rapid company growth.

3. Manufacturing – Construction Products:

Challenges: Fluctuations in raw material prices, rising energy costs, shortage of skilled labor in the construction industry, fluctuations in orders, and uncertain country credit policies affecting customer movement in the market.

Opportunities: Increased demand for construction materials meeting environmental standards and infrastructure development creates opportunities for investment in innovative materials and construction technologies. If the war in Ukraine ends, there is potential for very dynamic company growth. Potential government support programs for youth would drive demand for the company’s products.

4. Manufacturing – Food Products:

Challenges: Supply chain disruptions, difficulties in obtaining raw materials of appropriate quality, changing consumer preferences toward healthier options, and the need to meet high food safety standards.

Opportunities: Increased exports to EU markets and entry into new sales channels could be key sources of growth for companies in the food industry.

5. Manufacturing – Machines:

Challenges: Recession in the parent company limits production in Poland. Technological advancements requiring continuous modernization and economic uncertainty affecting capital investment decisions.

Opportunities: Industry 4.0 integration to improve efficiency and automation of production processes could provide a significant competitive advantage.

6. Transport and Logistics:

Challenges: Rising fuel costs, changing regulations regarding transport, and the need to adapt to the growth of e-commerce.

Opportunities: Innovations in “last mile” delivery and logistics optimization using digital solutions present significant growth potential in this sector. Providing customers with a broader range of services leads to higher customer satisfaction and retention. “One-stop shop” increases profitability and business viability.

7. Manufacturing – Packaging:

Challenges: Requirements related to eco-friendly packaging, legal regulations, and fluctuating raw material prices.

Opportunities: E-commerce growth creates a huge need for specialized packaging, which provides room for innovation and adapting products to market demands.

8.IT Services:

Challenges: Cybersecurity threats, talent retention in a competitive market, managing declining employee motivation, challenges with Generation Z, and rapid technological changes.

Opportunities: Services related to digital transformation, cloud implementation, and IT consulting are key areas for growth in IT companies.

9.Financial Services – Loan Company:

Challenges: Regulatory compliance, rising capital costs, and concerns about investment in Poland due to the war in Ukraine.

Opportunities: Very rapid growth in the loan market in Poland presents the opportunity for fast business scaling.

Conclusion

2025 will be a year full of challenges for CEOs of companies in Poland. Our interviewees highlighted the increase in geopolitical uncertainty, rising costs due to green deal regulations, high energy and labor costs, legal uncertainties, and the war in Ukraine.

Other challenges included better-quality products from China and the need to compete with these products, disruptions in supply chains, employee motivation issues, and shortages of skilled workers for blue-collar, engineering, and specialist roles.

These factors will require business leaders to be far-sighted, flexible, innovative, and able to adapt quickly to new realities.

Leaders agreed that geopolitical uncertainty—and consequently, business reality—has never been so dynamic, demanding rapid responses and organizational changes within the companies they lead.

We would like to sincerely thank all the CEOs who took the time to speak with us and invite all CEOs to a conversation about the expected challenges for 2026 in the fall of this year.

You can submit your request for a conversation in the fall by emailing e.adamczyk@naj.com.pl or d.wroblewska@naj.com.pl with the subject “2026.”

We will contact you in the fall to schedule a phone conversation and send you the 2026 survey results for Poland and the world as soon as they are ready.

The 2025 global CEO survey results can be found in the link below. What Challenges Await CEOs and Executives in 2025? Results of the Global IESF Study.